At the centre of the dispute is a critical part of the world's chip ecosystem.

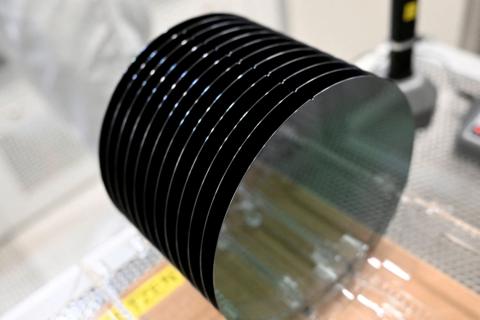

Nexperia makes so called "legacy" or "building block" semiconductors that are vital for everything from power-steering and airbags to central locking systems. These are not cutting-edge chips, but they are still indispensable.

Some vehicles contain hundreds of them, and Nexperia supplies chips to major carmakers around the world.

Around 70%-80% of its output is sent to China for processing, testing and packaging – a dependence that has left car makers exposed to Beijing's control over supply chains.

"Car markers blindsided by the Nexperia mess should be hiring new supply chain management executives, as they clearly learned nothing from Covid... and excessive reliance on [Chinese] supply chains," China watcher Bill Bishop wrote in his Sinocism newsletter.

It underscores China's ability to choke off global supply chains - just as it did with rare earth exports.

Similar to critical minerals, China can hold the West hostage with control of a company as inconspicuously important as Nexperia, according to Bill Echikson, Senior Fellow for the Tech Policy Program at Center for European Policy Analysis. This is as much about digital sovereignty as it is about semiconductors, he adds.

Beijing faces a dilemma though. It has been pitching itself as a reliable partner in the face of Trump's tariff chaos, but cutting off supplies of critical products risks undermining that message.

"The narrative was [that, since] Trump came in and caused chaos for everybody, maybe there's an opportunity for China and the EU to work more closely together," said Tom Nunlist, Associate Director at Trivium China.

That didn't go so well, he adds, with the rare earths shortage showing how trapped Europe and other trading partners are between the US and China, and their ability to upend global trade, according to Mr Nunlist.